Frequently Asked Questions - Membership

-

Who is eligible to join Shekinah Sacco?

The Sacco is open to any individual both adults & children who have yet to attain the age of 18. They should be of sound mind.

-

What are the benefits of being a member of Shekinah Sacco?

- Quick Loan Approvals & Disbursement Procedures.

- Low Loan Interest Rates.

- Access To Quick & Convenient Mobile Loans Of Up To 5k.

- Member & Beneficiary Last Expense Cover.

- 24/7 Access To Member’s Account Via Our Online Members Portal.

- Access To Deposit Based Loans Of Up To 2.5 Times Of Savings.

- Annual Dividends & Rebates On Member Deposits.

- Our Dedicated Team Is Highly Qualified & Ready To Serve You.

- Innovation In Terms Of Products, Service & Technology.

-

How do i become a member of Shekinah Sacco?

- Complete The Membership Registration Form In Full.

- Payment Of Non-Refundable Entrance Fee Of Ksh 500.

- Payment Of Non-Refundable By-Laws Fee Of Ksh 200.

- Attach A Copy Of Your Identity Card (Both Sides).

- Attach A Pair Of Colored Passport Photos.

- Attach A Copy Of Your KRA Pin Certificate.

- For children who are under the age of 18, The parents' details will be used to cosign.

-

What are the responsibilities of a member of Shekinah Sacco?

- Attending members’ education days.

- Adhering to your society’s by-laws.

- Attending Annual & Special General Meetings.

- Encouraging potential members to join your society.

- Liability for the debts incurred as a member and/ after ceasing to be a member.

-

What are the duties of the Shekinah Management Committee?

- Authorize investments by the society.

- Ensure the keeping of true and accurate records of account.

- Determine the interest rates on loans, subject to the society’s by-laws.

- Adhere to the Cooperative Societies Act, Rules and By-laws, and prudent business practices in all its activities and undertakings.

- Recommend to the annual general meeting, the dividend rate to be paid on shares, and the interest and refund payable to borrowers.

-

How secure are my Savings in Shekinah Sacco?

The Sacco is licensed & regulated by the Sacco Societies Regulatory Authority (SASRA). It is managed by board of directors and management as per cooperative Society’s Act, Rules and Sacco By-laws.

We have implemented the Good Corporate Governance Charter, Code of Ethics & the signing of the code of confidentiality. We also hold our yearly Annual Delegate Meetings where reports & financial accounts are represented to delegates. -

How do i Withdraw from the Sacco?

You are mandated to give a written notice of 60 days (normal withdrawal). Withdrawal is subject to clearance of all Sacco liabilities(Loans or any other debt).

Frequently Asked Questions - Savings

-

What is the Minimum Monthly Contribution?

The Minimum Monthly Contribution is Kes. 1,000, payable daily, weekly or monthly.

-

What is the difference between Share Capital & Member Deposits?

- Deposits are refundable while Share Capital is nonrefundable but transferrable to a nominee or another member.

- Shares are never used as a loan security while deposits may be used as loan security.

- Share capital earn dividends while savings/deposits earn interest.

- Members are not permitted to borrow against share capital as Shares are never used as a loan security while deposits may be used as loan security.

-

How do i go about transfering my Share Capital?

With the approval of the board, a member who wish to exit the SACCO may at any time transfer shares to another member but not to a non-member. Such transfers must be in writing by both the member exiting and the member buying the shares.

-

How do i Withdraw from the Sacco?

You are mandated to give a written notice of 60 days (normal withdrawal). Withdrawal is subject to clearance of all Sacco liabilities(Loans or any other debt).

-

What is a Dividend?

This is a share of the surplus of the society, which is divided amongst its members, based on the Sacco’s profitability & a member’s shareholding percentage.

-

How can i access my statements & account balances?

All you need to do is login to your online members portal whereby you will input your Member Number & ID number before setting up your unique password. Using this portal, you will be able to view your balances, apply for instant loans & also post feedback to the Sacco management.

Frequently Asked Questions - Loans

-

When do i qualify for a loan?

After six (6) months of saving with the Sacco.

-

What security is required for a loan?

- Guarantors (active members) and not loan defaulters.

- Member Payslip.

- Member Deposits.

- Collaterals – chattel mortgages.

-

Will i be penalized for clearing my loan early?

No, there are no penalties for this.

-

What is the maximum amount of loan i can borrow?

The loan amount shall not exceed 2.5 times of deposits held in the Sacco society.

-

How do i check my loan balances, status & statements?

All you need to do is login to your online members portal whereby you will input your Member Number & ID number before setting up your unique password. Using this portal, you will be able to view your loan balances, loan statement, apply for instant loans & also post feedback to the Sacco management.

-

Can i apply for more than one loan?

Yes, you can. As long as it's not the same product & also all lending conditions have been met.

-

Why was my loan application rejected?

- Inconsistency in deposit contributions.

- Inadequate guarantors.

- The loan form is not duly completed.

- Key documents like ID, certified pay slips, PIN, direct debit/standing order instructions etc. have not been attached.

- The member deposits are insufficient to support an additional loan.

- Poor repayment history.

- Presentation of forged documents amongst others.

-

What is the role of a Guarantor?

Guarantors are jointly & severally liable for the repayment of a loan in the event of the borrower’s default.

-

Who is eligible for the Sheeka Pesa Loan?

Any member can apply for this instant loan. All you need to access it is activate your online members portal and apply for the loan amount you desire.

-

Do i need to have security for the Sheeka Pesa Loan?

No, you do not need any security or collateral to qualify for this type of loan.

Frequently Asked Questions - Benevolent

-

Who is eligible to benefit from the Benevolent fund?

Any member with an active deposits account.

-

Who is covered under the Benevolent benefits?

The principal member & the nuclear family.

Loan Calculator

Check out our Loan Calculator & get a glimpse of our competitive loans rates.

Check It Out!

Contact Us

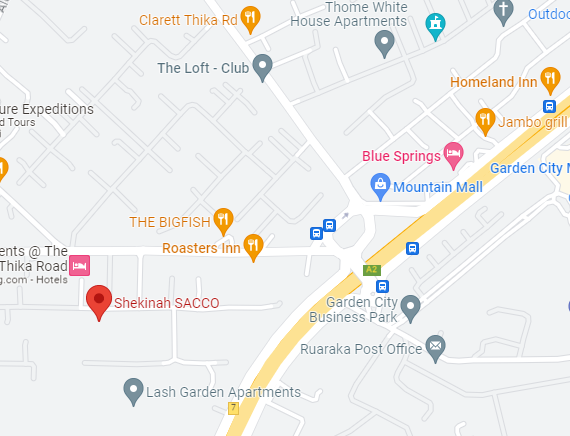

Our Address

House Of Transformation Church Grounds On Exit 7,

Garden Estate Road, Off Thika Rd, Nairobi

Email Us

info(at)shekinahsacco.com

shekinahsacco(at)gmail.com

Call Us

+254 0741 088 074

+254 0775 584 288