Existing Loan Refinancing

We offer this loans to members who need more money to complete projects by applying for a refinance loan.

This is akin to a top-up loan granted to a member who requires additional financing after the existing loan has been

granted. The loan is repaid under the same terms as the current running loan.

Requirements

- Collateral / Guarantors Required.

- Active & Full Sacco membership of at least 6 months.

- Qualifying loan should be 2.5 times a member’s deposits subject to a maximum amount of Kes. 5,000,000.

Benefits

- No penalties for early loan clearance.

- Maximum loan repayment period is 36 months.

- Loan Interest Rate is charged on Reducing Balance at 1% per month

- Security Options: Guarantors’ / Houses Member Deposits, Member’s Own Deposits, Motor Vehicle Logbook & Property Title Deed.

Loan Calculator

Check out our Loan Calculator & get a glimpse of our competitive loans rates.

Check It Out!

Contact Us

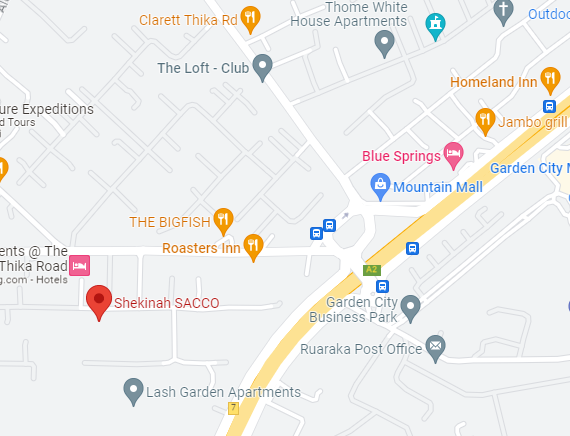

Our Address

House Of Transformation Church Grounds On Exit 7,

Garden Estate Road, Off Thika Rd, Nairobi

Email Us

info(at)shekinahsacco.com

shekinahsacco(at)gmail.com

Call Us

+254 0741 088 074

+254 0775 584 288